Now, it's one thing to have conservatives writing op-eds espousing conservative policies. It is another thing to let complete fools and failures like Michael C. Lynch with massive, massive past failures pretending to be experts on energy and writing outright lies.

Now, it wouldn't be fair if I said that without backing it up. So let's take a look at Mr. Lynch's past.

Back in November 1997, Mr. Lynch is quoted in Business Week as saying:

''Oil-price forecasters make sheep seem like independent thinkers,'' gibes Massachusetts Institute of Technology energy researcher Michael C. Lynch. ''There's no evidence that mineral prices rise over time. Technology always overwhelms depletion.''

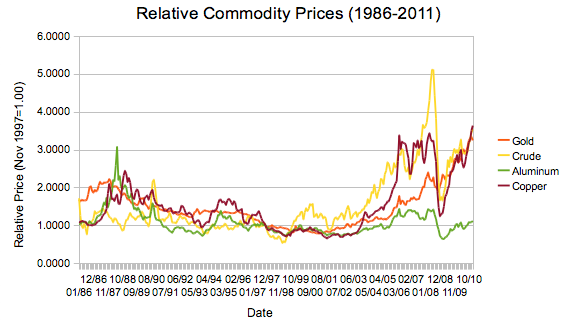

Notice that he didn't just limit this prognostication to his own field of energy. He made the claim that this holds for mineral prices in general. Now, take a look at the relative real prices (i.e. adjusted for inflation using the Bureau of Labor Statistics Consumer Price Index data) for four important minerals (crude oil, gold, copper, aluminum) over the last 25 years, with the baseline in November 1997. Note: the prices for the commodities can be found here

Now, obviously the prices of these minerals have been influenced to a large extent by general market factors; in particular, copper and crude oil took an especially large price drop (because the Great Recession caused a major demand reduction). Nevertheless, for gold, copper and crude, we've not seen technology overwhelm depletion; all 3 are (even when inflation is accounted for as it is in the above graph) costing about 3 times what they were in 1997, with a general rise starting in 2000. Only aluminum (one of the most abundant elements on the planet, although much of it is not easily accessible) has more or less remained the same.

However, that's not the worst of Mr. Lynch's failures.

Why is Mr. Lynch a massive failure? Take a look at this article from Forbes in October of 2006.

Don't sell that SUV just yet. Oil, at a recent $66.50 a barrel, will fall to $45 by mid-2007 and could dip briefly into the 20s in 2008. Sometime next year you are going to see a $1.95 price on a gas pump.

So says Michael C. Lynch, 51, president of Strategic Energy & Economic Research in Amherst, Mass. He swears he hasn't been inhaling fumes. His reasoning: New supply, coming online from all corners of the world, is more than ample to satisfy growth in demand and sufficient even to withstand an embargo against Iran, which produces 3.75 million barrels of oil a day. Lynch argues that the threat of disruptions--nuclear brinkmanship, war, terrorism, hurricanes, pipeline corrosion--has larded oil prices with a $20-a-barrel risk premium. As these perils recede, oil prices will fall.

Of course, as you may remember, we didn't see $1.95 in 2007. We saw in the $70 range in mid-2007, and a RISE into the 120s in 2008. The only reason we briefly got even close to his numbers in late 2008/early 2009 was because demand plummeted thanks to the financial crisis/recession. We never saw these "new supplies," and as demand began picking up again, so did prices. And these "new supplies" are in the form of oil shale/oil sands which are far worse pollution-wise than regular oil, and riskier and riskier deep-sea, which we just saw worked out just great this summer.

Yes, Libya/Algeria are a temporary thing (unless they aren't ...), but if relatively smaller producing countries like them result in these kind of price increases, what happens if there's a revolution in Saudi Arabia?

Much to the satisfaction of the peak-oil crowd, the Obama administration is throwing federal subsidies — some $8 billion in its 2012 budget — at all sorts of unproven, unrealistic and inefficient energy technologies like wind farms and electric cars.

Now, even putting his and everyone else's stupidity on climate aside, the man is still silly.

Yeah, so unrealistic/inefficient/unproven is wind; clearly it was the Bush administration's (nonexistent) massive federal wind program that has increased the percentage of U.S. electricity from wind from 0.17% in 2001 to 2.25% in the 12 months ending November 2010 (and growing); still not much, of course, but on the other hand, Libya produces only about 2.1% of world oil and yet it's still having a real effect.

As for electric cars, they're hard to prove without building/encouraging a charging infrastructure, but they are about to start being marketed even without the infrastructure.